How Spanish Banks Can Prevent Fraud by Streamlining Customer Communications?

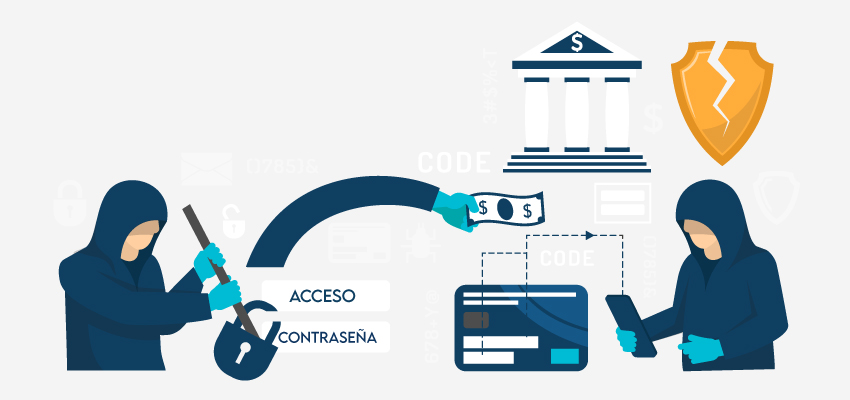

In 2023, fraudulent attacks increased by 117%. The increased attacks led to €250 million in losses, according to data from Spanish banks. The increase in fraud attacks included ATM fraud, debit card fraud, and bank transfer fraud. To combat the added increase in fraud, Spanish banks have started sharing data.

A survey from December 2023 found that good fraud protection is a top priority for Spanish customers when choosing a bank. 34% of respondents said it was their main consideration, and 72% ranked it among their top three concerns.

Banks that don’t protect their customers from fraud will not only face fraud losses but also struggle to attract and retain customers. The survey also revealed that 19% of Spanish respondents reduced or stopped using their personal bank account due to difficult identity checks, and 18% did the same with credit cards.

The Importance of Customer Communication in Fraud Prevention

1. Communication Helps Prevent Fraud

Streamlined communication between customers and banks is essential for fraud prevention. By involving customers in the fraud detection process, banks can respond faster and stop fraudulent transactions more effectively. However, communication must be tailored to each customer’s preferences. Multi-channel, two-way communication strategies have proven successful in fraud prevention.

When it comes to peer-to-peer (P2P) apps or online banking, the risk of scams and authorized push payment (APP) fraud is growing. Generic warnings are often overlooked but targeted, relevant messages can effectively alert customers. Multiple, thoughtfully crafted messages can even break through a scammer’s deception, prompting customers to take action.

2. Communication Enhances the Customer Experience

Customers expect strong fraud protection but also want a smooth, hassle-free experience. Poor communication can lead to two key issues:

- False Positives Become a Burden: Effective fraud detection tools reduce suspicious cases, but some situations still require customer input. Automated communication tools integrated with case management can speed up the process, reducing disruption and improving the overall experience.

- Fraud Prevention Can Disrupt the Experience: Identity checks are often necessary for fraud prevention, but long, intrusive processes can frustrate customers.

3. Communication Boosts Efficiency and Cuts Costs

Handling fraud claims is often a complex and time-consuming process. However, by using automated, omnichannel communication tools, banks can streamline fraud claims management and reduce operational costs.

Traditionally, each step in the fraud claims process—from initiating the case to providing forms and additional information—required manual input from fraud prevention teams. With the right technology, this can now be automated. Customers receive updates and can complete forms online, eliminating the need for costly mailings and reducing their desire to speak with an agent. This reduces the volume of inbound calls, leading to significant savings.

Summing Up

In summary, effective customer communication helps prevent fraud, enhances the customer experience, and improves operational efficiency. By putting customers at the center of fraud prevention, banks can protect both themselves and their customers while keeping satisfaction high.