Merchant onboarding (KYB)

In order to fulfill the requirements in KYB (Know Your Business), it is instrumental to verify submitted documents.

Preventive measures are key against the risks involved such as fraud, money laundering, and other criminal activities. Today, it often takes days, if not weeks, to onboard a merchant.

Submitted documents can often not be sufficiently verified, which expose organizations to unnecessary and high risk.

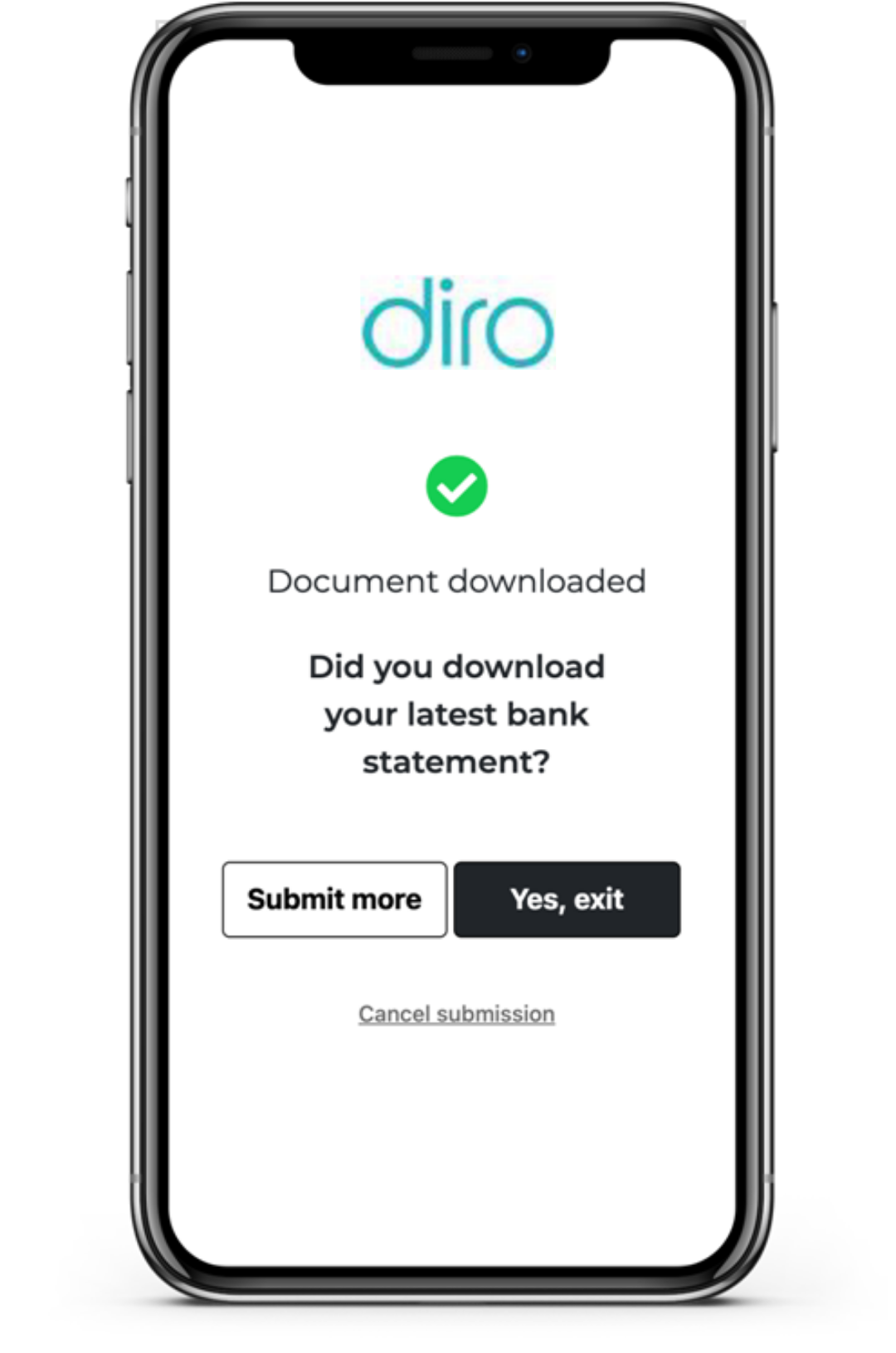

DIRO provides an improved onboarding experience where merchants can verify bank account ownership, proof of address, and incorporation documents in real-time.

In addition to authenticated documents, DIRO creates a machine-readable JSON files that can be fed into your decision engine for automation. DIRO helps to eliminate fake and stolen credentials, manual reviews, and OCR errors.

DIRO’s solution makes it possible for international financial institutions such as banks, payment providers, and crypto companies to have global coverage for regulatory compliance that otherwise was difficult or not possible.

Onboard merchants in seconds vs. days

Eliminate fake and stolen documents

Global coverage in 195 countries