By leveraging DIRO’s bank verification solution in vendor onboarding, Fraud.net helps Tier 1 global banks to verify bank account ownership in international markets.

Whitney Anderson — CEO, Fraud.net

Insufficient vendor due diligence expose businesses to high risk, money laundering, and financial crimes.

It is particularly important to verify bank account ownership of vendors, before paying invoices, to avoid payments in error and to prevent money laundering. Therefore, bank account verification is an instrumental step in KYB (Know Your Business).

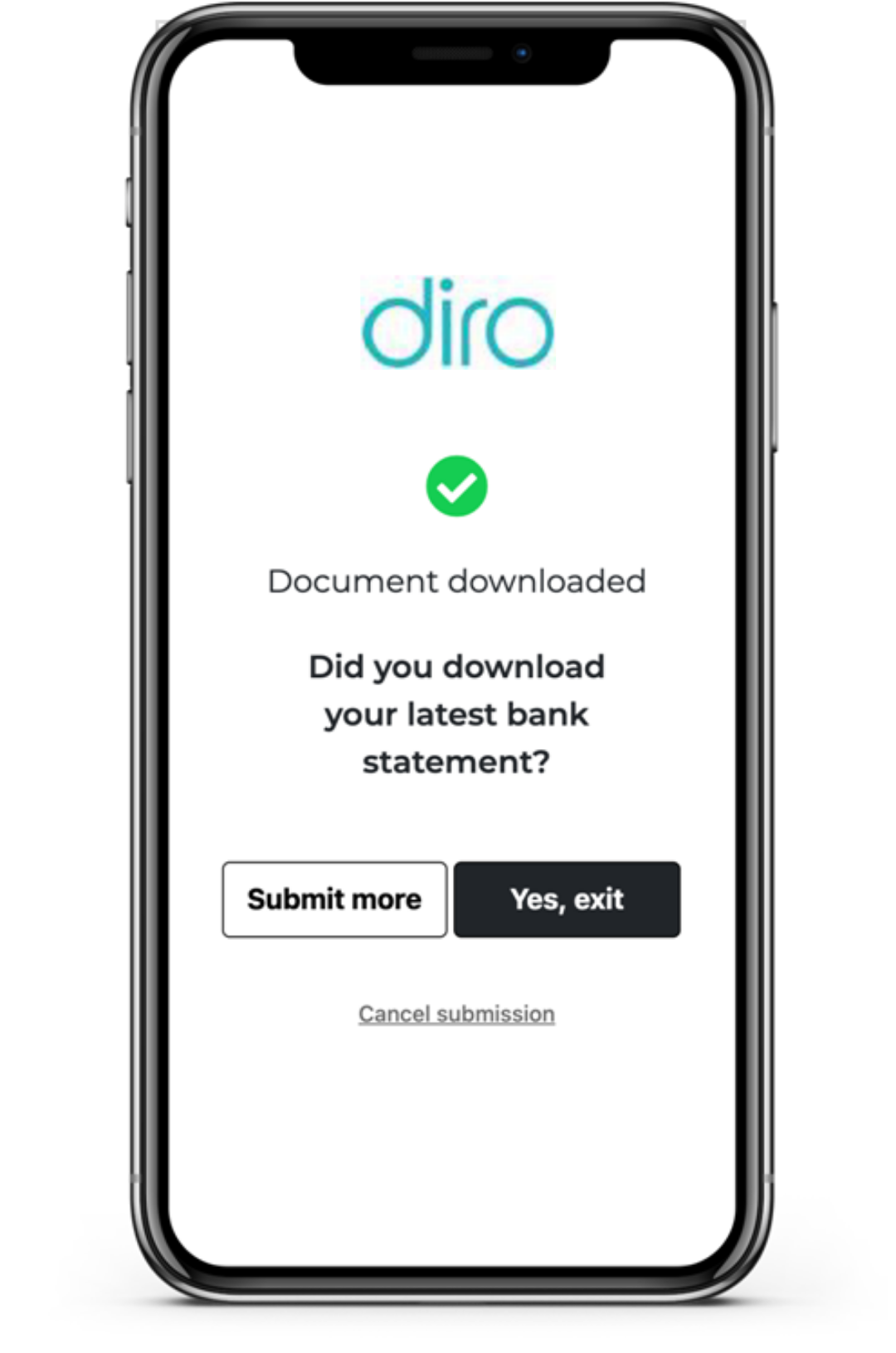

DIRO allows businesses to verify vendors’ bank accounts, proof of address, and incorporation documents in real-time. This helps to eliminate fake and stolen documents when onboarding new vendors.

Via Fraud.net’s fraud prevention and risk management platform, Tier 1 global banks use DIRO’s bank account verification solution in vendor due diligence across international markets. Verification of bank account ownership is a critical element in KYB to prevent fraud and incorrect payouts.

DIRO’s technology creates a machine-readable JSON file that can be fed into decision engines for real-time verifications. This process eliminates the need for human reviews and OCR errors.

DIRO’s solution makes it possible for international financial institutions such as banks, payment providers, and crypto companies to have global coverage for regulatory compliance that otherwise was difficult or not possible.

Fraud.net, headquartered in New York, United States, operates the first end-to-end fraud management and revenue enhancement ecosystem specifically built for digital enterprises and fintech globally.

By leveraging DIRO’s bank verification solution in vendor onboarding, Fraud.net helps Tier 1 global banks to verify bank account ownership in international markets.

Whitney Anderson — CEO, Fraud.net

Onboard vendors in seconds vs. days

Eliminate fake and stolen documents

Global coverage in 195 countries