Proof of identity

As part of KYC (Know Your Customer), proof of identity is a crucial step in customer onboarding. The challenge with verification of identity online is that the user can easily tamper driver license and passport with simple Photoshop. Even with advanced AI and liveness test, a fake identity can easily pass.

The underlying problem is that no government allows access to their database of photos to make the comparison possible. By relying on submitted driver license and passport alone, expose financial institutions to unnecessary risk.

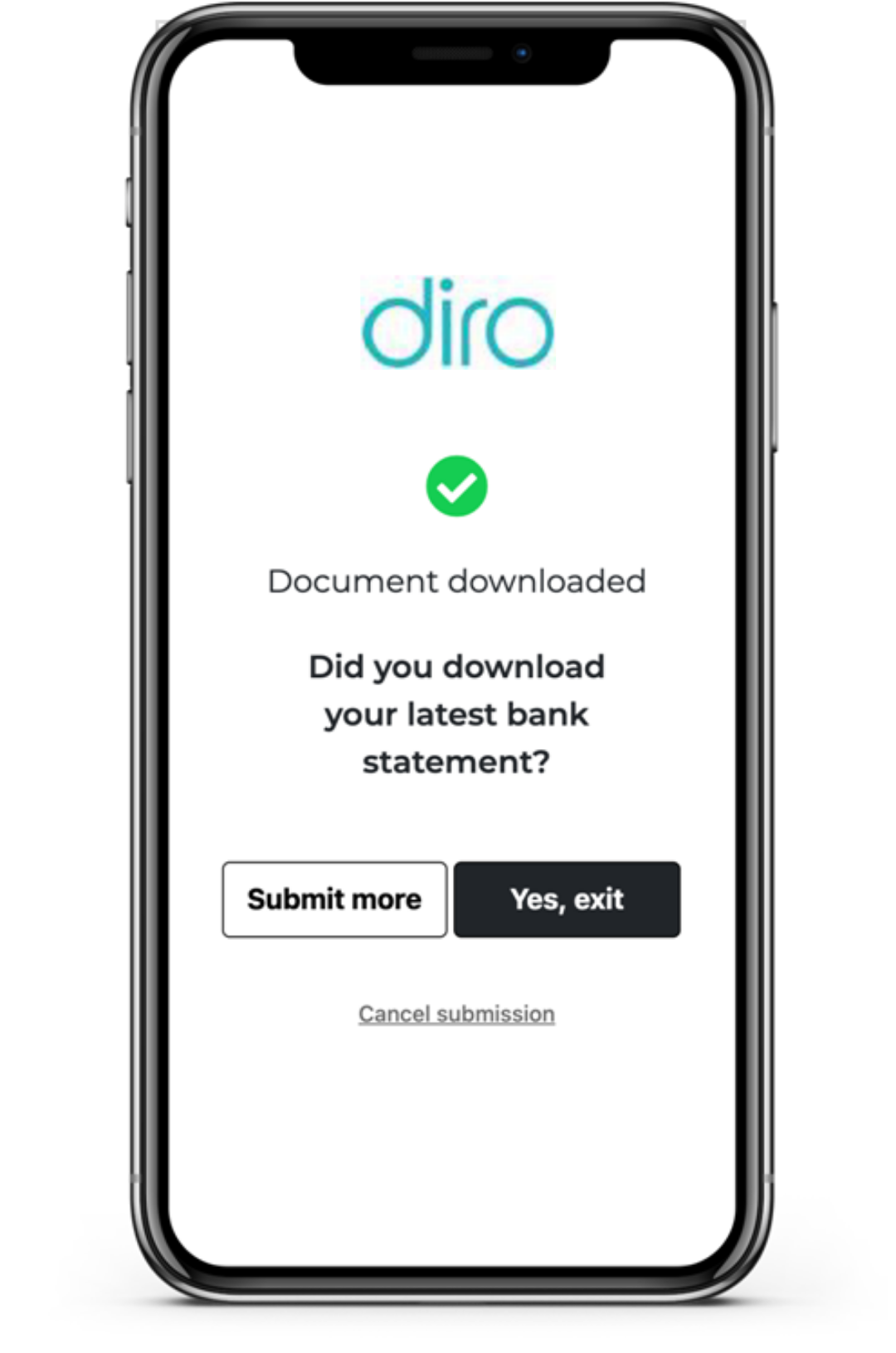

DIRO provides real-time verification of customer identity with successful logins at banks, utility, and government sources. The combination of two independent login, at trusted sources, provides proof of identity.

Multifactor authentication at login, at trusted sources, adds an additional layer of impersonation check and proof of identity. By combining verified data from trusted sources such as banks, utility, and government together with the information captured on a driver license and passport is the new way of verifying identities online.

DIRO’s solution makes it possible for international financial institutions such as banks, payment providers, and crypto companies to have global coverage for regulatory compliance that otherwise was difficult or not possible.

Verify identity based on bank, utility, credit bureau, and government data with built-in impersonation check

Leverage bank-grade KYC data to verify proof of identity

Eliminate fake and stolen documents

Global coverage in 195 countries