What’s Next for US & Canada in Open Banking?

Open Banking is an ever-changing industry. Financial institutions can benefit greatly from implementing open banking solutions. Several things are afoot in the open banking industry. On October 22, the US Consumer Financial Protection Bureau (CFPB) released the first-ever open banking rule, and the same day, a lawsuit was filed challenging the rule.

Open banking regulations are now in place for several countries and jurisdictions across the globe, including – UK, EU, Australia, Brazil, Japan, Singapore, and others. A lot of financial institutions and FinTechs benefit from the rich data. According to a study, 82% of banks in the UK were expected to be using open banking by the end of 2023.

Right now, the open banking regulations vary greatly based on the market and the region.

What’s New in Open Banking?

As we mentioned, the Consumer Financial Protection Bureau has proposed the Personal Financial Data Rights Rule under Section 1033 of the Dodd-Frank Act.

In Canada, the Financial Consumer Agency is working on open banking and named it consumer-driven banking.

As of now the US & Canada have nearly identical goals for the new regulation:

- Give consumers greater control & ownership of their financial data.

- Make security and consumer protection the primary focus.

- Foster innovation and competition in the financial sector.

Right now, the US has the most mature financial aggregation environment globally. Most US banks are using “bank account linking” during their onboarding process for new accounts and/or in their account management to improve:

- Credit line management

- Verification of income

- Other vital customer information

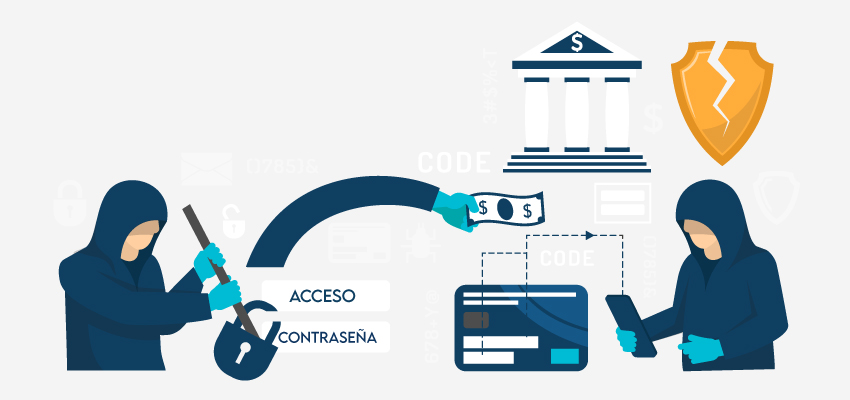

Canada is behind the US in terms of open banking regulation and in the usage of data. That’s because of 2 primary factors:

- Banks are trying to limit access in a defensive effort

- Security & privacy concerns, as it’s technically a breach of most Canadian bank’s online banking agreements.

Top 5 Open Banking Opportunities for Banks

Here are 5 reasons why banks should care about open banking:

1. Improved Verification of Essential Credit Application Data

Open banking makes verification of essential credit information easier, including data such as proof of income, rent, mortgage, and debts. Solutions such as DIRO’s online document verification, combined with the open-banking can enhance how credit application data is verified.

2. Low-Friction Experience for Customers

Customers today want a low-friction experience with digital banking. Open banking can facilitate the experience for customers. Seamless access to customer data and quick turnaround times will enhance customer experience.

3. Predictive Analysis

Open banking filled with rich customer data can improve the predictive models currently used for credit approvals. This can help the younger population and new immigrants who have little to no credit history. They only have savings/checking accounts.

4. Helps Understand the Nature of Small Businesses

Small businesses always face challenges when working with FIs on credit applications and demonstrating creditworthiness. Open banking data will significantly enhance the ability to understand the financial nature of small businesses.

This provides better predictability on credit performance and affordability, and it can shorten the time-to-decision performance.

5. Personal Finance Consultant

For many consumer banks, open banking can lead to AI-driven personal financial consultants. AI-based personal finance consultants will have to be trained on a lot of rich financial data, this can be done with open-banking data.