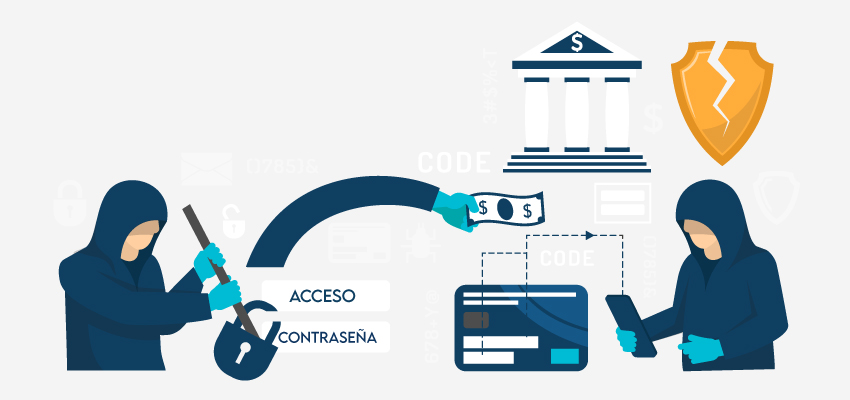

Bank fraud is getting harder and harder to spot, especially with so many free-to-use AI tools. Fraudsters today have an easier time conducting fraud compared to fraudsters a decade ago. Banking fraud increased by 11% between 2023 and 2024, which is concerning for both businesses and individuals. This is why it’s crucial to identify fake bank statements.

Manual verification methods can’t keep up with the standards set by bad actors. Identifying fake bank statements is the need of the hour to reduce fraud as much as possible. Some common methods can be utilized to identify fake bank statements.

Identifying Fake Bank Account Statements

Fake bank statements have one aim – to mislead individuals and businesses from getting legitimate account information. Fraudsters use a combination of fake and real information, with new technologies, to make fake account statements. Most bank statements are made to mislead the second party into thinking the financial situation is something else than it actually is.

A legit bank statement would typically include specific details, such as:

- Account holders’ names

- Account number

- Transaction history

- Bank contact information

A legit bank statement’s goal is to provide a comprehensive overview of financial activities, such as:

- Deposits

- Withdrawal

- Service charges

- Transaction history over a specific time period

- Opening & closing balances

Businesses require these bank statements to assess an individual’s financial health. Generally, this information comes in handy when an individual applies for a loan.

Why Do Fraudsters Make Fake Bank Statements?

There can be multiple reasons for building fake bank statements. The primary reason individuals make bank statements is to secure a loan. For instance, an individual may show their account balances or fabricated deposits to appear more financially healthy than they are.

Another reason could be to pay lower taxes or not pay taxes at all. Bank account statement fraud can also be used to meet rental requirements, secure job positions, or build business partnerships.

How to Fight Fraudulent Applications?

Unfortunately, the problem of fake bank statements is still prominent, and it has grown even bigger with the pandemic putting millions of people out of jobs. As a matter of fact, the problem with fake banks has become an even bigger nuisance for banks, financial institutions, building owners, and so on. The percentage of fake bank statements used increased from 15% to 29% in September 2020.

What makes this situation worse is that one in every 4 applications tends to go unnoticed. The increase in the number of undetected fraudulent applications can be allotted to the lack of proper verification solutions. Also, manual methods of verification can’t detect highly sophisticated forged bank statements. Automation and data utilization can be used to fight fraudulent applications.

Identifying Fake Bank Statements

1. Ensure that All The Figures Match Up

One common mistake that fraudsters make is that they don’t put in too much effort to ensure that all the numbers on the bank statements add up. If there is no money for automated verification processes, then you’ll need to take up your time to figure out if the numbers add up.

While identifying the bank statements, it is always a good idea to keep one thing in mind: people who fake bank statements will often use round figures. Proper round figures are usually a red flag while identifying if a bank statement is real or not.

2. Take to a Bank Rep

If, as a business, you’re uncertain that you have received a fake or genuine bank statement, then one way to be sure is to reach out to a banking representative. Call the bank yourself, don’t rely on any information that’s listed on the bank statement. Once you get through to a banking representative, confirm all the details you want to confirm.

In most cases, a banking representative will ask for a copy of the document. Chances are that you may not get much support from the bank. Various banks will try to prevent the manipulation of documents by adding some kind of digital signature to the PDF files, although this feature is usually used to protect investment accounts.

3. Search for Inconsistencies and Errors in Documents

The first potential red flag regarding the bank statements is the major & minor inconsistencies in the documents. Are the font size and the font type consistent with other document types of the same bank? Is the bank’s logo accurate and up to standard? People who create fake bank documents often get lazy, and these inconsistencies can help in preventing online fraud. Do the numbers add up in the document, and does the ending balance make sense? Are there any suspicious withdrawals? If the bank statements contain any of these inconsistencies, then you may need more research.

4. DIRO’s Online Document Verification

While you can rely on manual methods of verification for a lot of things, they still have some limitations. By utilizing technologies, you can easily distinguish between fake and real documents. DIRO’s bank document verification software verifies documents instantly and provides strong proof of verification backed by verifiable credentials. DIRO’s online document verification tool can verify over 7000 documents from all over the world by cross-referencing document data from an original web source.

The technology can eliminate the barriers of manual verification and enhance the overall document verification process, and eliminate document-related fraud.

5. Irregular Transactions

Another red flag to notice is transactions that are irregular, numbers that don’t match up, or bank statements that don’t include a clear timestamped record of financial activity. Some red flags that are most common include:

- Rounded or repeated deposits: Multiple transactions that have identical payments or identical transactions with rounded figures ($5,000) each month.

- Unusual activity patterns: No record of utility bills, groceries, standard monthly expenses, especially for personal accounts.

- Backdated transactions: Be on the lookout for transactions that don’t match public holidays or weekends, or during bank holidays.

- Inconsistent running balances: Check the opening and closing balances of the account after deposits and withdrawals.

- Deposit descriptions: Look for transactions that don’t match the stated employer.

How to Prevent Bank Statement Fraud?

Prevention is better than a cure is not just a saying; for businesses dealing with bank statement fraud, it is a must-do. Some key strategies for preventing bank statement fraud include – conduct regular reviews, education & awareness, and advanced technologies for fraud detection (check DIRO). Let’s break these steps down one by one:

1. Conduct regular reviews and systematic vigilance

The first thing to prevent bank statement fraud is to set up a framework for regular review of financial statements. Having a framework in place with early detection of discrepancies or anomalies can help businesses and individuals identify risks of fraud.

Audits should become a regular part of businesses and financial institutions to prevent fraud. These audits can help identify inconsistencies that may go undetected otherwise.

2. Educate and aware employees

Businesses should make it a habit of educating their teams to prevent fraud. Basic education practices include regular communications, workshops, and providing resources that help employees identify risks of fraud.

Anyone who deals with bank statements in the company should be able to understand the common red flags of fake bank statements. Train employees about common practices fraudsters use, mistakes to spot in bank statements, and teach them how to use software for bank statement verification, such as DIRO.

3. Leverage AI and Technology

If fraudsters can use AI and the latest tech to conduct fraud, businesses should fight them on equal footing. Businesses should integrate AI and fraud-combating tools in their frameworks to ensure that no fake documents can be used to conduct fraud.

Tools like DIRO’s bank account verification solution can verify bank statements in real-time by comparing the data from the issuing source, proving the legitimacy of the documents.

Conclusion

Verifying fake bank statements is crucial for businesses to prevent financial fraud. Bank statement verification is a must-have part of the loan underwriting, tenant screening, compliance, and fraud prevention processes. Businesses should build solid processes that can help in bank statement verification and reduce the risk of online fraud.

Frequently Asked Questions

What is the Difference between a bank statement and a bank letter?

Individuals often get confused between bank statements and bank letters. They’re both issued by banks and used for verification, however, they serve 2 different purposes in financial and compliance workflows.

Here’s a breakdown:

- Bank statement: A detailed record of financial activity over a time period. Issued by the account holder’s bank, either through online banking portals or mailed statements.

- Bank letter: Sometimes also called the bank reference or proof of account. It is a formal confirmation that an account exists and is in good standing. It’s issued by the bank but only when it’s requested by the account holder.

How serious is bank statement fraud?

Bank statements fraud can have a serious impact on both businesses and financial institutions and can have severe consequences. Individuals who fall prey to bank statement fraud sometimes end up taking steps that can compromise their integrity and financial health. This is why businesses need to set up a framework for combating fraud.

Who needs to verify the integrity of bank statements?

Bank statement fraud is a huge problem for both individuals and banks. A lot of industries and businesses rely on bank statements to identify the income, financial history, and financial health of an individual. This is why a lot of fraudsters try to use bank statements as a means of fraud.

Here’s a list of industries and businesses that often use bank statements for financial verification:

- Lenders: Loan providers, payday lenders, or mortgage providers use and verify bank statements to assess financial situations and make lending decisions.

- Landlords and tenant screening: Landlords often use bank statements to verify income or financial responsibility.

- FinTech platforms: Often need document-based onboarding, so they verify bank statement verification.

- Insurance companies: A lot of insurance companies that request bank statements as part of the claims process, especially during fraud investigations.

- Employers and HR teams: Employers and HR teams ask for bank statements for proof of income verification.