Digital age verification is crucial in this day and age. So in this article, we will talk about how age verification works, different rules and regulations, and minor protection in different parts of the world. Almost everyone can get easy access to digital products and services. According to a survey in 2015, almost 1.46 billion consumers purchased goods over the internet. This number increased drastically by 46% since 2021. This can be credited to the COVID-19 Pandemic. In the current situation of the world, more and more people love to purchase products online. While the rising number of online customers is great for online businesses, it also creates challenges.

Today, minors can easily get access to age-restricted content from all over the internet. Unlike the offline world, where minors can’t get access to alcohol or tobacco, buying goods online is completely different. According to research, more than 1 million minors fell prey to ID theft in 2017, which resulted in a $2.6 billion loss.

What Is Online Age Verification?

Online age verification is a process to protect individuals and audiences from consuming non-age-appropriate content. Merchants of age-restricted products need to take responsibility to sell their services only to people over their age. For online businesses, it is essential to understand the age of their users, and digital age verification is a great way to get around it. It is a safe way for minors to perform online activities, and maintain regulatory compliance.

Digital Age Verification vs Manual Age Verification

Since the inception of adult-based services, verifying your age has become a common practice. Tobacco and alcohol stores don’t allow minors to purchase and consume these products. According to regulations by the Food and Drug Administration (DSA), the minimum age for buying and selling tobacco products is 18. These laws can perfectly work in offline stores as there is someone available physically to verify age. When it comes to online stores, verifying the age of an individual becomes challenging.

So, it makes sense that minor protection rules should also apply to digital businesses. Digital business vendors often just ask for usernames and passwords to protect the users. There’s a huge need for verifying the age of minors before they interact with these platforms. Fortunately, just recently there have been huge developments in the online age verification methods.

Compared to a couple of years ago, verifying an individual’s age has become relatively easier by relying on biometrics technology. There are several age verification systems available today that rely on AI and Machine learning to smartly identify if the individual behind the screen is minor or grown-up.

How does Digital Age Verification Work?

Age verification helps businesses onboard legitimate customers and prevent minors from using age-restricted processes. Here’s how most age verification processes work:

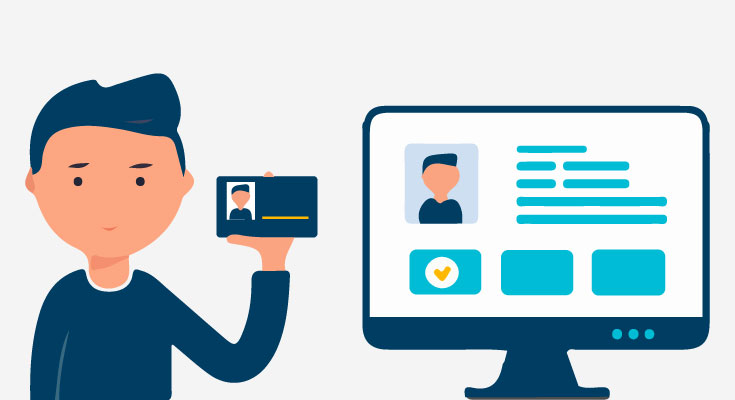

1. Submit the Date of Birth

The user has to submit date of birth information including date of birth using an online form as provided by the vendor.

2. Upload Documents

Users upload date of birth documents that are issued by the government. These include documents such as ID documents, driving licenses, or passports.

3. Verification Process

Based on the information provided by the users, businesses verify the age of the users. This happens by using a document verification solution or an online ID verification solution. Based on this verification, the end-user is verified and declined.

Global Age Verification Guidelines

Different geographical locations have different guidelines when it comes to age verification. If there’s one thing similar about all the guidelines, it’s that all of them focus on parental controls. The main purpose is to make parents aware of appropriate services for their children and obtain consent for the children to use these services.

1. Age Verification in UK

The UK government made some changes in 2017, to make sure that a country is a safe place for children. Following that, some changes have been made to the laws to limit easy access to age-restricted products and services.

The online age verification provider, interactiveAgeCheck (iAC) is responsible for minor protection. This is backed by CitizenCard, UK’s biggest photo-ID and age verifier organization. It thoroughly considers recommendations made by the UK Council on Child internet safety.

2. Age Verification in Europe

The GDPR (General Data Protection Regulation) is issued by the European Union and applies to the citizens living in EU states. It has a complete set of rules and guidelines for the collection of personal data. This information includes biometrics, health, and genetic information. The GDPR’s Article 8 allows the age of consent to be anywhere between 13-16. This suggests that anyone over the age of 16 in the EU is allowed to consume age-restricted products and services.

3. Age Verification in USA

The Federal Trade Commission’s minor protection law is named COPPA. It’s one of the most impressive and crucial minor protection laws in the USA. The rule book outlines how companies should collect and verify information related to children under 13. complying with these regulations doesn’t just include age-restricted content warnings, or integrating an age verifier.

The Cellular Telecommunications and Internet Association issued guidelines on restricting career content not suitable for younger audiences. It outlines different content rating standards so that the parents are aware of the type of content suitable for their children. By using internet access control offered by major internet carriers, consumers can limit access to specific websites using filters or block certain websites.

4. Age Verification in Australia

The Australian Communications and Media Authority (AMCA) put out a new guideline in 2008 to prohibit minors’ access to age-restricted content. These regulations apply to anything aired in Australian media or hosted on TV channels within the country. The broadcasting Services Act of 1992 played a vital role in the development of these frameworks.

For every content rating group, these rules offer a different set of customer verification, the MA15+ guidelines require:

- A warning message that the content is MA 15+

- Safety information for parents to protect their children who are below 15

The RA18+ guidelines contain rules regarding:

- Warning about the risk of using proof of age by another person or someone who’s not eligible based on their age

- Consider which evidence is provided, and how it’s presented

Risks of Not Completing Age Verification Checks

There are some risks of not having the age verification methods. These include non-compliance and a drop in market reputation for offline and online businesses at the same time. Generally, the perceived level of risks involved figures out the level of control and application of the regulatory framework.

Here are some risks of not having proper age verification mechanisms in your process:

1. Compromised Market Reputation

Building a great business requires providing customers with the best customer experiences. User satisfaction is crucial in building loyalty for customers and building a good reputation for your brand. Not investing in age verification software can hurt your business by having a negative brand image. Not having a proper age verification process can lead to easy access to age-restricted products and services, it puts minors more at risk.

2. Non-Compliance fines

All kinds of vendors and organizations have to comply with GDPR, regardless of the type of products and services they offer. The purpose of this regulation is to maintain privacy and secure record-keeping. These regulations are equally important while verifying the age of individuals during onboarding processes. Non-compliance with GDPR can lead to hefty fines for businesses.

Till 2016, non-compliance fines for COPPA were 160,000, which were later increased to 43,280 dollars.

3. Financial Losses

Online businesses can reduce fraud in chargebacks by parents for non-consenting transactions. Having an age identifier or verification process integrated into your onboarding process can help in reducing financial losses.

Conclusion: Importance of Age Verification

In the end, the age verification process is crucial to protect the young generation from the adverse effects of age-restricted products and services. Merchants have to take on the social responsibility to secure minors and restrict their access.