Blogs

Building the future of fintech.

What is Loan Fraud Definition? – Steps to Avoid It

Loan fraud is one of the most common fraud types, it involves practices that aim to secure loans using false information or secure a loan with a plan not to pay. Fraudsters intentionally misrepresent their financial situation or the purpose of a loan to obtain funds they are not entitled to receive. This is achieved […]

Read more

Digital Income Verification: What is it, how it work?

Digital income verification is revolutionizing how businesses confirm an individual’s income by leveraging electronic data. This method allows companies to automatically access information from various sources, such as banks and payroll services, streamlining the process of income validation. The Need for Digital Income Verification As industries evolve, the demand for faster and more accurate income […]

Read more

What is CIAM? A Deeper Dive into Customer Identity & Access Management

In today’s digital age, managing customer data securely is a top business priority. Customer Identity and Access Management (CIAM) refers to the processes, tools, and technologies that help organizations manage customer identities while ensuring seamless access to online services. While this may sound similar to traditional Identity and Access Management (IAM), CIAM has distinct goals […]

Read more

How to Protect the Underbanked from Online Fraud?

Millions across the globe use digital banking services every day. But there’s an even bigger portion that has limited access to basic banking services, let alone the digital one. This segment is known as underbanked. To make the underbanked transition to digital banking and normal banking is a huge challenge. Digital banking opens the doors […]

Read more

8 Best AML Solutions Businesses Can Use in 2025

Navigating the twists and turns of global financial regulations in 2025, the demand for robust Anti-Money Laundering (AML) technology is more critical than ever. It’s no longer just about compliance; it’s about safeguarding your operations from the sophisticated tactics of financial fraud and laundering. This guide spotlights the top 8 AML solutions of 2025, with […]

Read more

What is Fraudulent Conveyance and How It Works?

Fraudulent conveyance is a term used in law to describe the illegal transfer of property or assets from one person (or entity) to another with the intent of evading debts or defrauding creditors. This deceptive action typically occurs when someone tries to shield their assets from creditors by transferring them to a family member, friend, […]

Read more

Identity Vetting – What is it, How it Works?

In today’s digital world, where online transactions, remote work, and digital services are rapidly increasing, ensuring that individuals are who they claim to be is more critical than ever. As a result, identity vetting has become a cornerstone for organizations seeking to protect sensitive information, maintain trust, and prevent fraud. In this blog, we’ll delve […]

Read more

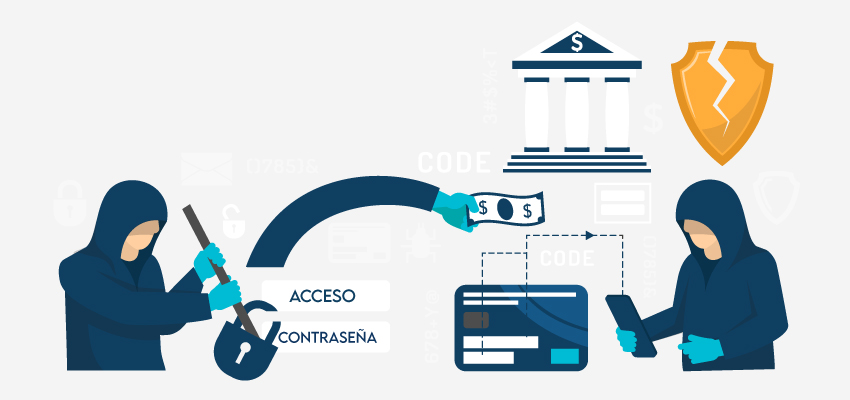

How Spanish Banks Can Prevent Fraud by Streamlining Customer Communications?

In 2023, fraudulent attacks increased by 117%. The increased attacks led to €250 million in losses, according to data from Spanish banks. The increase in fraud attacks included ATM fraud, debit card fraud, and bank transfer fraud. To combat the added increase in fraud, Spanish banks have started sharing data. A survey from December 2023 […]

Read more

What is PSD2 Compliance? Everything You Need to Know About It

Businesses must stay compliant with all emerging regulations, not just for legal reasons, but also for keeping themselves afloat. One important regulation businesses must comply with is the PSD2 compliance, also known as the Revised Payment Services Directive. The EU enforces PSD2 and the regulation aims to improve consumer protection. The second part of the […]

Read more

How Hyper-Personalized Communications Can Prevent Scams?

Financial institutions are increasingly being required by regulators worldwide to enhance their communication with customers when a scam is suspected. While these regulatory steps are crucial in combating scams, some organizations are already going beyond the basic requirements. In this blog, we’ll discuss all the instances where hyper-personalized conversations can deter fraud. Recent Regulatory Changes […]

Read more